Do you dream of spending your retirement drinking Bordeaux and champagne in Paris? Perhaps you want to spend it in a beautiful seaside villa in Biarritz or the ski the Alpine slopes of Chamonix at the base of Mont Blanc? If France sounds like your idea of a dream retirement destination, here’s what you need to know.

Getting a French Visa

Normally it is a simple matter to visit France. But the COVID-19 pandemic has prompted the government to suspend issuing visas, including short-stay visas.

Once the pandemic has passed, it should be relatively easy for Americans to get long-term residency in France. If you plan to stay in France for more than a year, you will need to get a “carte de séjour”. This is a residence permit and you must get it while still in the United States. It is not possible to apply for a French residency card as a tourist while in France. You will need to provide plenty of documentation including:

- A passport

- Application forms

- Extra passport photos

- Proof of financial self-sufficiency

- Proof of international medical insurance

- Proof of where you will live in France

You can apply for the visa at a French consulate or by mail, but you will need to report to a consulate or embassy in person for an interview as well. You can expect the visa process to take at least one to two months. Additionally, you should contact your closest French consulate before sending in your application materials to ensure that you have everything you need. This will help to ensure that the application process does not take longer than necessary.

Once you are in France, you will have to reapply for your carte de séjour annually. After three years of living in France under this residency permit, you can apply for a 10-year residency card. This residency card will allow you to work if you want to and will renew automatically.

Housing Costs in France

In general, the cost of living in France and the United States is similar, but rent costs significantly less in France than in the United States. According to data from Numbeo, the average rents in France are 37.89% lower than in the United States.

Because rent is significantly less in France than in the United States, you can live a similar lifestyle for less. If you keep the same budget as you have before moving to France, you’ll likely have plenty of funds left over each month to either spend or save. Food, utilities, entertainment, and other consumer goods are priced similarly to what you’d find in the United States.

Healthcare in France

Healthcare in France has been ranked the best in the world, according to the World Health Organization. As a resident, you will have the same healthcare benefits as French citizens. You will be asked to show proof of foreign health insurance to obtain your visa, but you can receive national healthcare benefits when you are a French resident.

A typical visit to the doctor costs $30. As a resident, you will receive 70% of your healthcare costs back. Prescription medicine is less than half the price you pay in the U.S. for most drugs. If you develop a need for long-term healthcare such as diabetes or cancer treatment, the medication will be free. You will be expected to pay any fees or charges at the time of your visit.

Hospitals and private clinics offer some of the best quality of care in the world. Specialists have fixed fees dictated by the government, so you do not have to worry about overpaying in the French healthcare system.

The healthcare system and health insurance in France

French law stipulates that all residents of France must have health insurance. This can be through the public healthcare system or a private scheme.

In 2016, the government introduced of a new universal public healthcare system – Protection Maladie Universelle (PUMA). The scheme’s introduction means most expats are now eligible for state French health insurance (l’assurance maladie).

Individuals not covered by the PUMA or who want to increase their health coverage can instead opt for private health insurance policies.

How to apply for public health insurance

The first step to acquiring health insurance in France is to either join the social security system or visit your local CPAM (Caisse Primaire d’Assurance Maladie).

Employers typically register their employees with social security and arrange their healthcare formalities. However, it’s your responsibility to check this has been done. Self-employed workers apply via the Régime Social des Indépendants (RSI).

If you qualify under PUMA, visit your local CPAM or send your application by post. CPAM assesses your rights, but the social security authority determines if you contribute towards your healthcare costs. If you earn below a certain threshold, you qualify for free healthcare under CMU-C.

Firstly, you’ll need to present a CERFA form, proof of identity and residence, translated birth and marriage certificates, proof of three-months’ residence in France, banking details, evidence of income, and your declaration de medecin traitant (doctor registration). During registration, you can add beneficiaries or dependents.

After activating your health insurance, you may need to formally request your carte vitale. This can take a long time to be processed, but you can ask for a temporary insurance card (attestation de couverture sociale) to cover you while you wait.

You can update your carte vitale annually by inserting it in the green box at CPAM offices, hospitals, and pharmacies.

Registering with a doctor in France

Residents over 16 years old and covered by the state medical insurance are required to register with a family doctor (médecin traitant). This is to access the full reimbursement of their medical costs.

Failure to do so will lead to penalties of higher medical fees and lower reimbursement rates.

Anyone 16 years or younger can visit any GP without fear of financial penalty. Once you’ve registered, you will receive a Declaration de Médecin Traitant. For more information, read our guide to registering with French doctors.

French health insurance providers

Some of the largest French health insurance companies, or mutuelles, include:

People from Outside the EEA

If you live outside the EEA (as is now the case for UK nationals) and you relocate permanently to France as a retired person, you will need to check with the relevant authority in your home country whether there are any reciprocal agreements with France. The position between the UK and France was set out in our article Post-Brexit Health Cover for Visitors and Pensioners.

You will be required to take out private medical insurance, as you will need to justify you have the resources not to be a burden on the French social security system and to have health insurance cover. This cover will need to be taken out before you will be granted your visa.

Ultimately, however, if you establish a right of residence in France of whatever duration, you will be able to make application for State health insurance cover.

The indications are that the French authorities are allowing access to the health system after three months legal residence, although we are seeing many different local interpretations of the regulations.

In all cases, the period of your cover will be no longer than the period of your visa/residence permit.

Accordingly, all we can advise is that if you arrive in France with a residence permit and suitable health cover, then once you have established at least three months residence you should consider applying for admission to the health system. If you are successful, the cover should last at least for the duration of your residence permit, which may then be renewed.

Taxes in France

In your first few years in France, you will not be authorized to work. If you choose to work when you receive your 10-year residency card, you will be taxed at the same rate as locals.

If you plan to use the French healthcare system, you will need to be paying into the national social security fund. If you are not taking an income in France, you must fill out a Form E121/S1 from the Department of Work and Pensions.

Foreign residents of France are also taxed on their retirement income. Whether this is from a pension or otherwise, you will be required to show proof of your financial independence and pay taxes accordingly.

When does one become a French tax resident?

Subject to international tax treaties, you will be considered to be domiciled in France for tax purposes if you meet at least one of the following criteria:

- Your home is in France: it is your usual/permanent place of residence.

In the presence of minor children, judges can check in which country they are enrolled in school to determine their usual place of residence. - You reside mainly in France: this is the famous “183 days” rule. Thus, if you spend more than half of the year in France, you become a French tax resident.

- You are working in France, whether or not you are an employee.

- You have in France the center of your economic interests: it is in France that you have made your main investments, or that it is the headquarters of your professional affairs. It is in France that you derive most of your income.

As soon as you are considered to be domiciled in France for tax purposes, you are subject to an unlimited tax obligation: you must declare all your French AND worldwide income in France.

In which country will my pensions be taxed?

Will your income be taxed twice? do not panic! France and the United States have concluded a tax treaty in order to avoid double taxation situations. The procedures for taxing pensions are detailed in Article 18:

“Amounts paid under the social security legislation or similar legislation of a Contracting State to a resident of the other Contracting State or to a citizen of the United States, as well as amounts paid under a pension plan and other similar remuneration arising in either Contracting State in respect of previous employment to a resident of the other Contracting State, in the form of periodic payments or a lump sum, shall be taxable only in the former State. For the purposes of this paragraph, payments under a pension plan and other similar remuneration shall be deemed to arise in a Contracting State only when paid by a pension plan or other retirement plan established in that State.”

In other words, this means that pensions and payments recognized as such are taxable only in the “paying” country. Thus, pensions from American sources are taxable only in the United States.

Which pension schemes are recognized by France?

For the purposes of Article 18 of the Tax Convention, France recognizes*:

- Qualified plans under section 401 (a) of the Internal Revenue Code;

- Individual retirement plans (including individual retirement plans that are part of a simplified employee retirement plan that meets the conditions of section 408 (k), individual retirement accounts, individual life annuities and accounts covered by section 408 (p) ];

- The qualified plans covered by section 403 (a) and those covered by section 403 (b) are generally considered to be a pension plan established, established and recognized for tax purposes in France.

Do you have any reporting obligations in France?

Yes, as a French tax resident you are required to declare all your worldwide income. Article 24 of the same tax treaty defines the procedures for avoiding double taxation. Thus, income that is only taxable in the United States must be declared on the French tax return, but the tax in France is cancelled thanks to the charging of a tax credit equal to the amount of the corresponding French tax.

SOURCE: https://www.cabinet-roche.com/en/taxation-of-american-pensions-in-france/

Safety in France

Overall, France is a safe country, especially outside large cities. In a few urban areas, though, the French have had a recent history of terrorist attacks, and there is crime in some of the poorer banlieues (suburbs) around Paris. They have made several changes to their public security measures and have implemented anti-terrorism powers. On the whole, violent crime, vehicle crime and otherwise occur at similar rates to the United States.

Be sure to check the website of the U.S. State Department for any travel alerts.

carte de séjour

Source: https://internationalliving.com/countries/france/visa/

Being issued with a residence visa is only the start of the bureaucratic fun. Once in France, you then must apply for a residency card from the administrative offices of your local préfecture, the département’s main town. Depending on status, two types are issued to foreigners: the carte de séjour and the carte de résident. Most foreigners (unless married to a French citizen or the parent of a French-born child) are issued a carte de séjour.

For the first three years in France, you will be required to renew your carte de séjour temporaire. After three years, you can request the 10-year carte de résident, which is renewable. This allows holders to work as salaried employees in France. Note, though, that a 10-year card isn’t granted as a right. As with a residency visa, a great deal of documentation is needed before your carte is issued. Documentation varies depending on the préfecture, but generally, you will need:

- Valid passport with the long-stay visa plus photocopy of passport title page and French visa page.

- One recent passport photo.

- Proof of financial resources.

- Proof of medical insurance or a medical certificate issued by a doctor approved by the French Consulate. (Full translation of details of foreign medical insurance is required, also.).

- Proof of domicile in France.

International bank accounts

HSBC EXPAT PREMIER ACCOUNT

The HSBC Expat Premier Account is an award-winning bank account available in sterling, dollars or euros. Included with the account is a debit card, a Foreign Exchange app as well as a complimentary travel security service. The account is access via 24/7 phone access, mobile banking app, online or a dedicated Relationship Manager.

LLOYDS INTERNATIONAL ACCOUNT

Lloyds International Bank Account is designed for moderate earners who need easy access to their money when living abroad. The accounts are domiciled in either the Isle of Mann or Gibraltar and can be held in either £GBP, €EUR or $USD. Each account comes with a monthly fee and it is possible to hold multiple currencies in the account. If you earn less than £50,000 per year, you can also open an account if you have £25,000 to invest or save with Lloyds.

NATWEST SELECT ACCOUNT

The NatWest Select account is designed for expats and foreign nationals living in the UK who are internationally mobile. Accounts can be opened in Sterling with multi-currency options available if required once a sterling account is held. NatWest also offers Telephone, Online and Mobile banking support.

MONEYCORP PERSONAL ACCOUNT

With moneycorp, you can make an overseas payments in over 120 different currencies to 190 countries. This allows you to save money on transfers to overseas banks and send your money where it needs to be. You can process an international transfer over the phone, or send money online in up to 33 different currencies. You can also use your account as a personal UK bank account to receive pension payments or other income in £GBP.

STANDARD BANK OPTIMUM ACCOUNT

Opening an international bank account with Standard Bank is easy and within the reach of anyone wanting to expand their horizons. With a low entry point, the Standard Bank Optimum Account is your door to a world of international banking. Expats need look no further if they want the assurance provided by an established bank able to offer holistic banking solutions.

Before making any decisions about your finances, you should always seek independent advice.

Source:

https://www.expertsforexpats.com/products/best-expat-bank-accounts/

also

A way to transfer money internationally

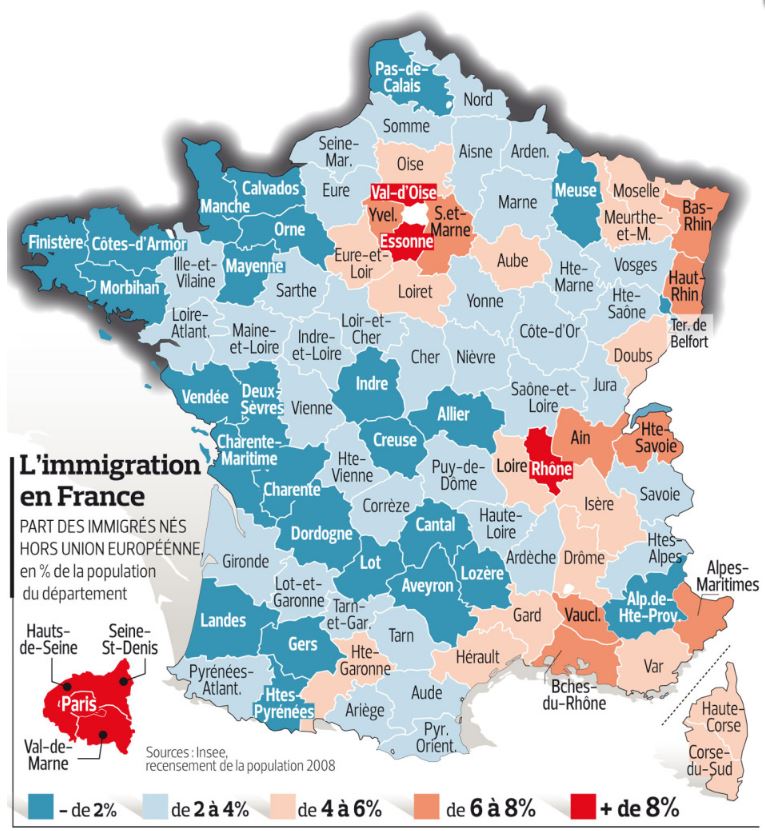

Where to live in France

When posting this question you should identify your preferences

Q- Retired or working?

Q- City or village

Q- Mountains or coast

Here is a map of where others have chosen to live. source.

Shipping Your Stuff

Rule #1 Travel Light, they sell stuff in France

But if you must ship, here are a few modest costs ways to send suitcases and parcels.

What Should I Look for When Choosing a Luggage Delivery Service?

Reputation, user reviews, timeliness, value for money, and sufficient insurance coverage are all important things to look for when choosing a luggage delivery service. The best service for you also depends on your specific requirements. Some companies can send luggage anywhere in the world while others are only for domestic trips. Others specialize in deliveries for students, while others are designed with business people and athletes in mind.

How Much Does It Cost to Ship Luggage?

The cost of shipping luggage varies greatly depending on a wide range of factors, including which company you use; the number, size, and weight of your bags; where you’re shipping them to; and how fast you want them to get there. For the cheapest domestic rates, choose LugLess. For the most competitive international rates, we recommend Luggage to Ship or Send My Bag for students.

Source: https://www.tripsavvy.com/best-luggage-delivery-services-5072273

Best Overall: Luggage Forward

:max_bytes(150000):strip_icc():format(webp)/LuggageForward-1965319aeb4b4b55b9c337e718b9f011.jpg)

Industry leader Luggage Forward has more than 7,000 independent customer reviews on Trustpilot and an impressive rating, with the vast majority of clients expressing their complete satisfaction with the company.

Punctuality and excellent service are mentioned repeatedly. In 2009, the company acquired eight other luggage delivery companies—giving it the scope to offer the best pricing and infrastructure out there. You can ship everything from luggage and golf clubs to bicycles, skis, and snowboards—all with door-to-door pick-up and delivery.

If you’re booked on a cruise, Luggage Forward can have your bags delivered directly to your stateroom. Luggage Forward is also the exclusive provider to 80% of the world’s premium and luxury cruise lines including: Cunard, Holland America Line, Oceania, Princess, Regent Seven Seas, and more.

If you’re traveling overseas, their electronic Customs management system handles all the necessary forms for you. Your luggage’s journey is fully trackable from start to finish, and the company is so confident in its ability to deliver on time that they offer a full, money-back-plus roughly $500 guarantee on every bag they ship.

You can book online or call anytime since they are open 24 hours a day.

Best Budget (Domestic): LugLess

:max_bytes(150000):strip_icc():format(webp)/LugLess-89f16918ffab4be0bdf1588c0e4d3b5b.jpg)

LugLess is the budget branch of Luggage Forward. It offers the cheapest luggage delivery service for domestic destinations, allowing you to ship your suitcases, packing boxes, or oversized sports equipment for the price of the airline baggage fees or less.

To do this, LugLess uses an algorithm to compare the cheapest quotes from FedEx and UPS. You get a barebones service but have the option to pay for added extras, such as doorstep pickup and increased coverage.

The cheapest option is to drop your luggage off at your nearest FedEx or UPS depot. At the other end, delivery to your residential address, hotel, resort, or golf course is included free of charge; but if you won’t be there to pick it up in person, you can opt to have your bags delivered to a FedEx or UPS location, and collect it within seven days.

You can track your luggage online at every stage of the journey and will receive a notification when it arrives. Note: You have to pay extra for live support.

Best Budget (International): Luggage To Ship

:max_bytes(150000):strip_icc():format(webp)/LuggageToShip-9900dbed59854572ae57090a9b670bb8.jpg)

If you want a budget luggage delivery service that can handle international shipments to more than 220 countries and territories, check out Luggage to Ship.

This company acts as a comparison site for FedEx and DHL, using an algorithm to find the cheapest service for your particular bag size, travel route, and time scale. It claims to save travelers more than 70% in shipping fees in comparison with leading premium luggage delivery services. Once you’ve accepted the quote, shipping labels will be prepared and mailed or emailed to you for attachment to your luggage.

Luggage to Ship offers door-to-door collection and delivery, or pick-up and drop off from your nearest FedEx or DHL location. From start to finish, your luggage’s journey is tracked and monitored. In the event of any customs’ delays or exceptions, Luggage to Ship will communicate between you and the carrier.

The company also offers up to six months of free storage at its warehouses in New York or Delaware. Storage costs roughly $10 per month for each piece thereafter.

Best for Students: Send My Bag

:max_bytes(150000):strip_icc():format(webp)/SendMyBag-df30581aa8c64acfb1c94806c66b6bf8.jpg)

Based in the U.K., Send My Bag offers door-to-door delivery of suitcases, boxes, and sports equipment to more than 100 countries. Typically, delivery to most major cities can be achieved within two days.

Although the company now caters to every kind of traveler, it began as a solution for international students wanting to move their belongings from home to college and back without the hassle and expense of checking it in with their airline. Today, it is still the preferred option for students.

If you have an NUS Extra, ISIC, or Student Advantage card you can expect roughly a 10% discount on all regular shipping rates. Send My Bag also offers the best price-guarantee, a complimentary cover on every bag, and an online tracking service.

If you opt for their express service within the United Kingdom and Europe, your bags are guaranteed to arrive on time, or you get your money back. Best of all, the company is open to customer queries 24 hours a day, either via live chat or telephone (local rates apply).

Best for Business Travelers: DUFL

:max_bytes(150000):strip_icc():format(webp)/DUFL-919d930a778644ab94d33ddd3a0549f3.jpg)

More than a luggage delivery service, DUFL acts as a personal valet for business travelers.

Here’s how it works: you store your business attire with the company and then use the app to virtually “pack” ahead of each trip. Your suitcase will be delivered to your destination ahead of time, so that you can travel luggage-free through the airport without wasting time waiting at the baggage claim. When your trip is over, DUFL will collect your luggage from the hotel, then clean and store your clothes ready for your next trip.

On average, the company estimates that their service saves travelers between three and five hours per round trip (i.e. the time you would otherwise have spent packing, unpacking, doing laundry, and handling your luggage at the airport). For busy corporates for whom time is money, this service is therefore invaluable.

Prices are fixed for domestic trips and charged directly to the credit card on file upon completion of each journey. International service is available for select destinations only and requires 10 days’ notice.

Best for Sports Enthusiasts: DUFL Sports

:max_bytes(150000):strip_icc():format(webp)/DUFL-1e612da300094340b4bda4b0d04a0ab4.jpg)

Athletes who like the sound of DUFL’s business solution will be pleased to hear that the company also has a dedicated app for handling sports equipment.

This is especially helpful for those who have to travel to pursue their passions (i.e. land-locked scuba divers or snow bunnies living in Florida) and don’t have the space to store their gear at home. Professional sportsmen and women who frequently travel across the country to compete can also benefit greatly from using this service.

It works in much the same way as it does for business travelers: Simply send your gear to the DUFL warehouse, where it will be inventoried, photographed, and stored in your virtual closet. When you want to travel, enter your itinerary details online and receive a quote to deliver your equipment directly to your destination.

Afterward, your sports gear is collected, cleaned, and stored for your next trip, saving you the expense and hassle of transporting it through the airport yourself. Costs depend on the size and weight of the equipment.

Best for Skipping Baggage Claim: Bags

:max_bytes(150000):strip_icc():format(webp)/Bags-a5105ed6f15644a682bb60af57154fe7.jpg)

If you’re interested in having your luggage delivered because you can’t stand the hassle of traveling through the airport with your bag in tow and hate having to wait at baggage claim, Bags could be the service for you.

This company offers several different travel solutions, including remote airline check-in, valet parking, and airport wheelchair assistance. They also allow you to check your bag in as usual at the airport, and then have an agent retrieve it from the baggage claim for you.

While you get started on enjoying your vacation straight away, the Bags agent will deliver your belongings to any address within roughly 100 miles of the airport.

Many major cruise lines and high-end resorts use Bags to offer a seamless luggage delivery service to their clients, and they have plenty of experience with more than 5 million bags handled annually. They also specialize in delivering luggage that has been lost or delayed by the airline, providing real-time updates about your bag’s status.

Best for Customer Service: Luggage Free

:max_bytes(150000):strip_icc():format(webp)/LuggageFree-be236045f7104a478b54739aed0e0bbf.jpg)

Respected luggage delivery company Luggage Free also has a high Trustpilot rating (though with fewer reviews than Luggage Forward) and uses FedEx, UPS, and DHL to ship domestically and internationally to more than 130 countries.

The white-glove service offers shipping for luggage, golf clubs, bicycles, and ski equipment and will prepare the shipping labels and customs’ documents for you. Collection and delivery are door-to-door for your convenience, and you can monitor the progress of your bags daily up until final delivery.

On-time delivery is guaranteed, and there are dedicated specialists available to help you every step of the way. And, if bags are late for any reason, you will receive your money back and around $500 in compensation.

Each bag also includes about $500 insurance, with the option to purchase more.